Blog

Customs Tariff and Import Duties

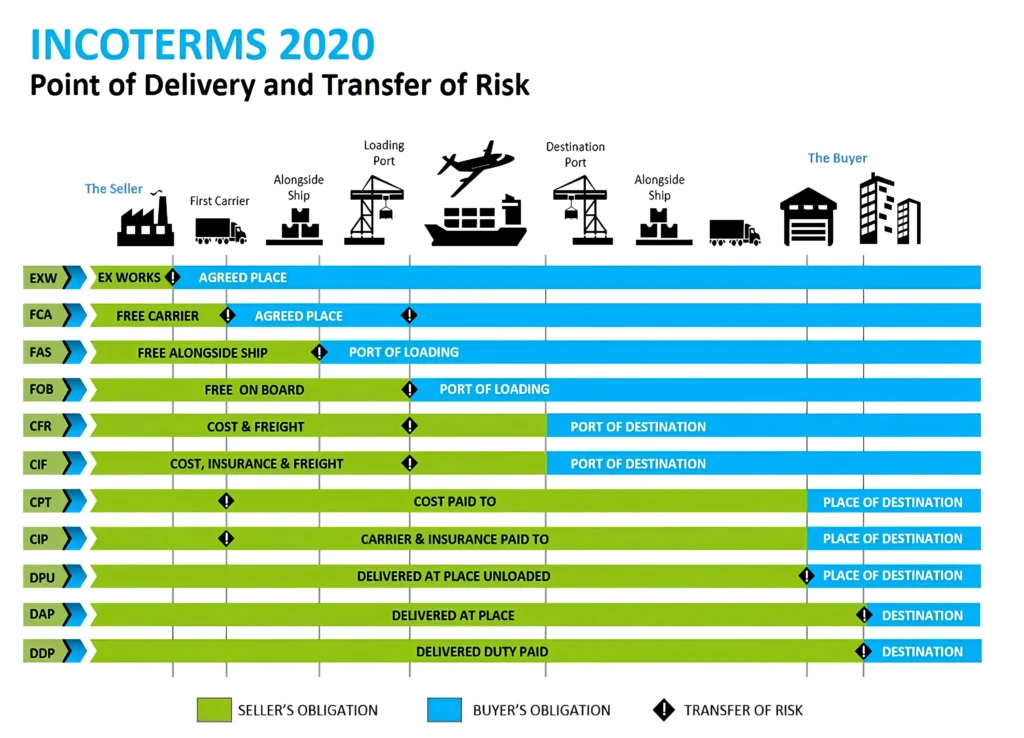

Steps to determine tariff classification and import duties Find the HS Code Go to the Customs Department website (www.customs.go.th). Select the “Tariff Search” menu. Enter the product description in Thai or English to search for the correct tariff code. Choose the 8-digit HS Code to view detailed classification. Check the import duty rate Visit the Customs Tariff Search System (itd.customs.go.th). Select Section 12 to view the applicable duty rate (after any reductions) or select FTA to check preferential duty rates under trade agreements. Calculate the CIF value, which consists of: Cost + Insurance + Freight. Calculate import duty using the...

read moreSep

Blog

Trade Agreements and Tax Privileges

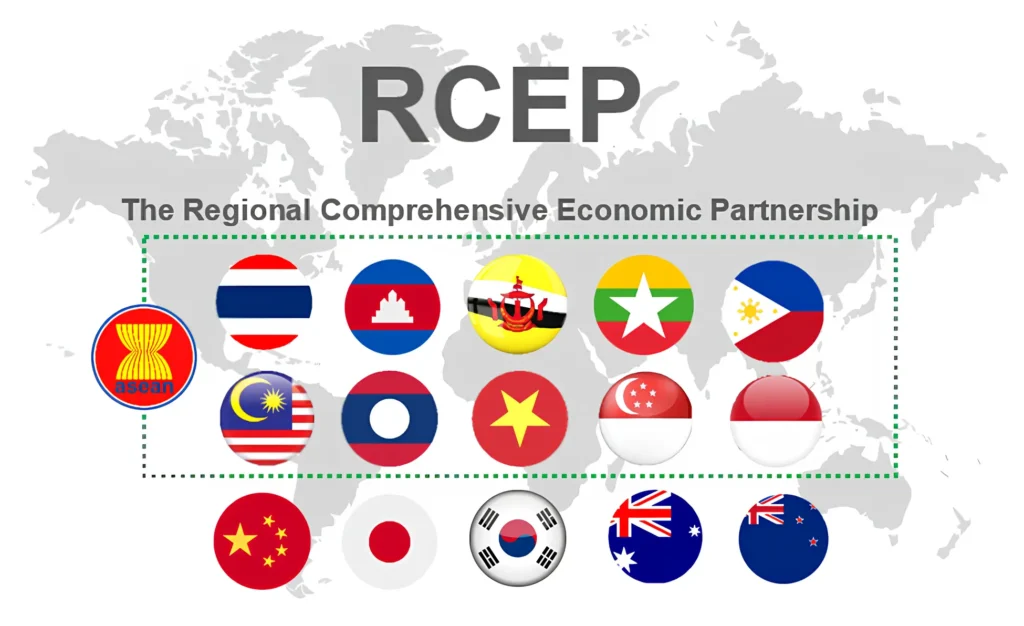

AFTA (ASEAN Free Trade Area)The ASEAN Free Trade Area consists of 10 member countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam.The Certificate of Origin used to claim tariff reduction or exemption for goods traded among member countries is Form D. ACFTA (ASEAN–China Free Trade Agreement)An economic cooperation framework between the 10 ASEAN member countries and China.The Certificate of Origin used to claim tariff reduction or exemption for goods traded under this agreement is Form E. JTEPA (Japan–Thailand Economic Partnership Agreement)A bilateral agreement between Thailand and Japan aimed at strengthening economic cooperation by reducing and eliminating...

read moreSep

Blog

Import Procedures in Thailand

Importing goods into Thailand involves two main steps: registering as an importer and obtaining specific licenses for the goods. Registering as an Importer Businesses must register as an importer/exporter with the Customs Department via the Customs Trader Portal. Alternatively, Bizcon Logistics Co., Ltd. can assist with the registration process. Required documents include the English company name registered with the Department of Business Development and the original ID card or passport of the authorized signatory. Once approved, the registration remains valid for 1 year from the date of authorization. Applying for Specific Import Licenses Some types of goods require prior approval...

read moreSep

- 1

- 2

TH

TH